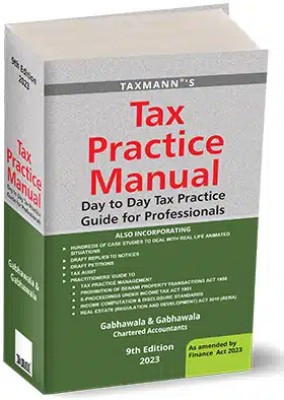

Tax Practice Manual Is An Exhaustive (2,100+ Pages), Amended (By The Finance Act, 2021) & Practical Guide (330+ Case Studies) For Tax Professionals(Paperback, Gabhawala & Gabhawala)

Quick Overview

Product Price Comparison

Tax Practice Manual is an exhaustive (1,900 + pages), amended (by the Finance Act 2023) & practical guide (330+ case studies) for Tax Professionals of India.This book will be helpful for Chartered Accountants, Lawyers/Advocates, and Tax Practitioners to assist them in their day-to-day tax work.This book is divided into two parts:Law Relating to Tax Procedures, including Tax Practice (covering 25+ topics)330+ Case Studies (covering 30+ topics)The Present Publication is the 9th Edition and has been amended by the Finance Act 2023. This book is authored by Mahendra B. Gabhawala with the following noteworthy features: